I was one of those kids who always tried to make the “right choice.” You know, do a good job in high school, go to college, get an intellectual job—that kind of kid. I grew up in the ever so competitive Jewish community amongst the future lawyers and doctors of America, and challenged myself to make those “right choices” to keep up with the abnormally wealthy Schwartzes.

So, as a nice Jewish girl with not so much family money, that’s what I did. And student loans helped me get the job done.

I bounced in and out of community college for a few years while getting some great work experience in, but my educational journey finally picked up steam in 2005, when I moved to Las Vegas and was admitted to UNLV. When it comes to student loans, unfortunately, what happens in Vegas does not stay there.

Cut to 12 years later, and here I am, a high school English teacher, with a student loan debt amount that I’m really not comfortable sharing with you. The only reason I’m not comfortable is because I don’t know what it is—it could be $171,000; it could be $217,000; or it could be $334,000. Depends on who you ask.

You see, I have three degrees. A bachelor’s degree (of which I was an out-of-state student for three semesters), a teaching credential (earned online), and a master’s degree from a California state school. And I really can’t tell you what stresses me out more—the total amount I owe or the fact that three corporations who control my credit worthiness can’t agree on the facts.

I guess you can call me “lucky.” I wasn’t a teen mom or a teen drug addict (but I was the Long Beach JCC Teen of the Year). I’m certainly not perfect, but I did OK for myself. I don’t make much money, but I am using my degrees, which is something not a lot of English majors can say. And I’m still making decent choices.

But I will always have this elephant in the room, no matter what I achieve or do. As I write this, I’m scraping pennies together to save for two trips to Spain, two weeks apart. I bought a version of my dream car (originally at a 15% APR for the first year) and while there was pride, there was also a twinge of guilt—should I be spending money on these things when I owe so much? When my boyfriend died in 2013, I made a promise to not forget to live. I am trying not to feel guilty about my upcoming trips to Europe—Nik would have wanted me to follow my passions. But I can’t keep on going financially without some major changes to the student loan system in this country.

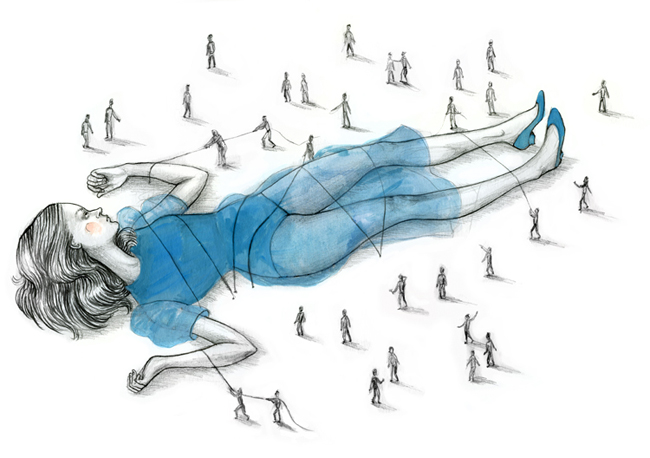

I’m not looking for a handout. I pay my bills every month—student loans included. I realize there is interest on everything, but I still see my balances go down on all my accounts except student loans. It might take a while to pay off my car, but I’ll get there. It’s my student loans which is chasing my interest rates to be so high. It’s a vicious cycle that I can’t escape. It almost feels like being penalized for wanting to make something of myself by getting a decent education. An “intelligence tax,” if you will.

About a month ago, I was finally able to consolidate my federal loans to one big loan, and more importantly, out of the hands of the evil Sallie Mae aka Navient. I was enrolled in a program that not only lowered my payment but will cancel my loans after 120 payments. Finally, it pays to be a teacher!

I still have the trouble of my private loans, though. About 25% of my total is private, and there’s really nothing I can do about them, save paying the bare, bare minimum interest-only payments and continuously hoping that one day some politician reads some inspiring bill aimed to take down for-profit student loan companies and release me from my chains. Because don’t forget—I am willing and ready to pay off my education, no matter how long that might take me. Just not the excessive amounts of interest.

It’s the interest—the greediness of these for-profit companies—that are holding hostage my ability to save money for a house, a down payment on a car, hell, a month long tour of Southeast Asia if I damn well please. Remember, I’ve played fair. I’ve made the “right choices.”

But even worse than frustration, these loans are weighing on me physically. I’m now showing symptoms of Lupus. Parts of my body swell randomly, I suffer from worsening joint pain all over, and I am exhausted all the time. I have been suffering from these weird symptoms for years, but only a few weeks ago did doctors finally put two and two together and notice that the sum of their parts was Lupus. I don’t “have” it yet, though, I am only “showing symptoms.” According to doctors, the only thing I can do to control the illness from becoming full-blown is to limit and control my stress. So I suppose for my health, I should just look past my dismally low credit score and house-worth of interest to save myself a lifetime of autoimmune disease symptoms and joint pain?

Or do I fight, on the off chance that I might win? Do I let my credit scores sit and drag down my financial future for the sake of my health, or do I continue to spend hours on the phone with various corporations trying to get to the bottom of these huge discrepancies and just let the Lupus take over?

What would you do?

Illustration via Flickr/Helena Perez Garcia